Mikuláš Peksa:

Should we even be concerned about the finances of Hollywood starlets and big business players, however? Why is it even a ‘problem’ when someone takes advantage of favourable tax rates? This two-part set of articles will try to answer these questions. Before we even focus on those, though, let us first clarify what OpenLux is all about. I will try to explain that in this text.

Why Luxembourg?

Supranational corporations, global billionaires and celebrities, arms dealers alongside Russian and Italian mobsters – this colourful mix could easily make up an original Bond movie cast.

Small country, big money

The sheer financial volume is especially remarkable compared to the size of Luxembourg’s economy. Luxembourg, with its 610,000 inhabitants, is a fairly small country and its GDP amounts to roughly 58 billion EUR.

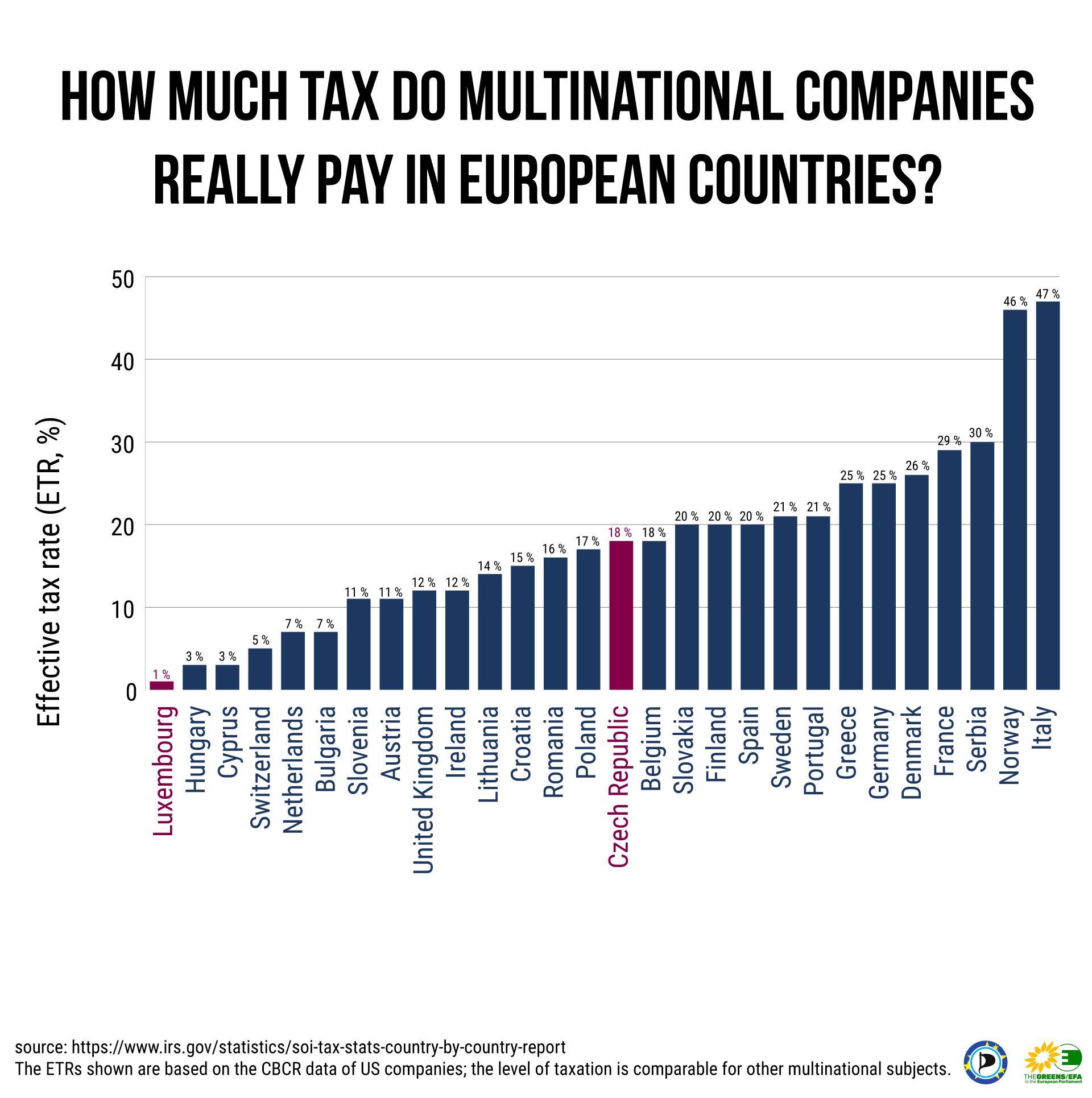

The amount of assets managed by Luxembourg offshore companies equals to over a hundred times more and corresponds to roughly a third of the EU’s GDP. What is more – Luxembourg has one registered company per every five citizens. Considering the fact that the effective tax rate in Luxembourg soars to such heights as the aforementioned 1%, we are left with little choice but to paraphrase John Cleese’s famous observation: “Look my lad, I know a tax haven when I see one, and I am looking at one right now!”

More transparency

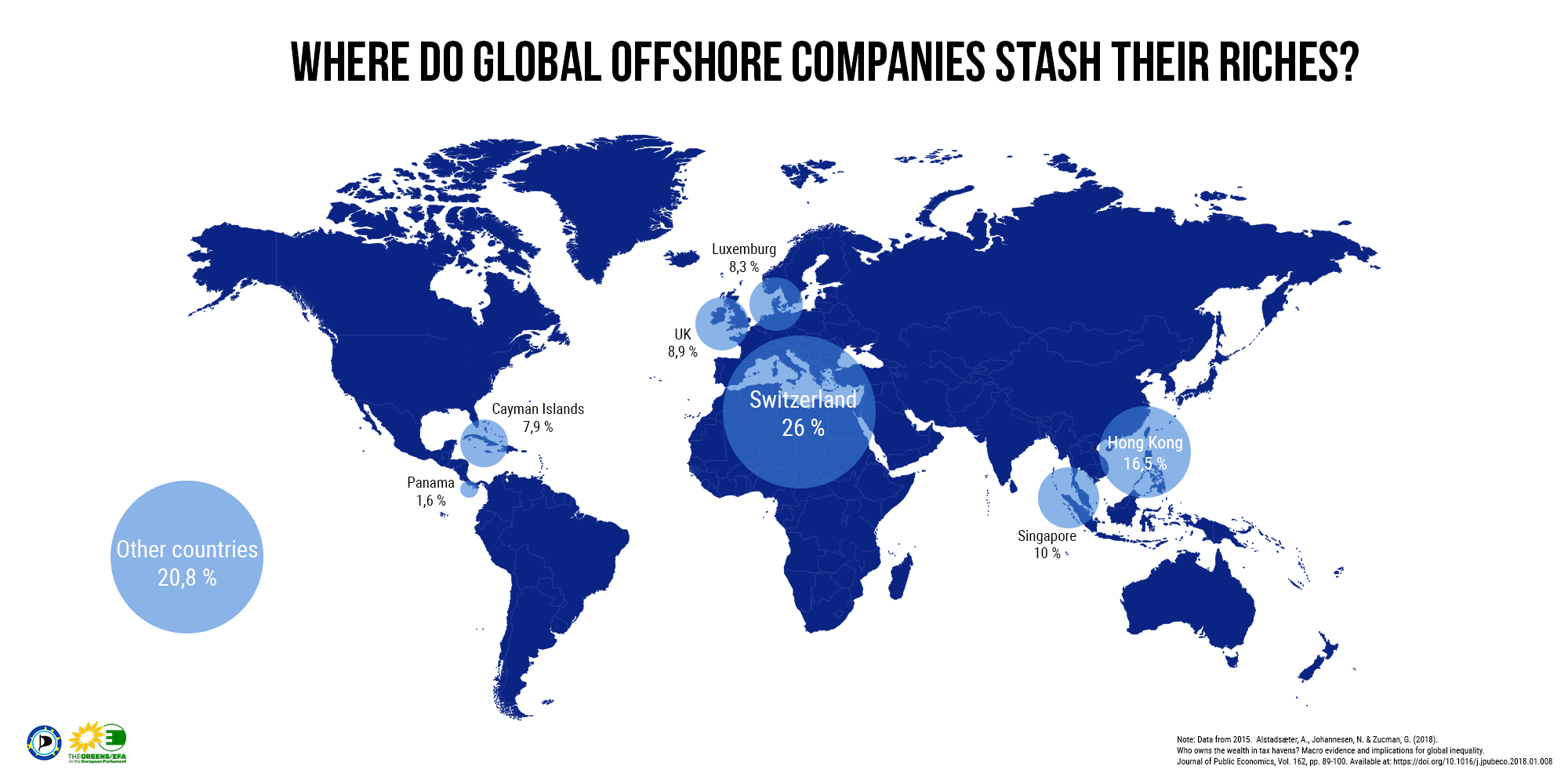

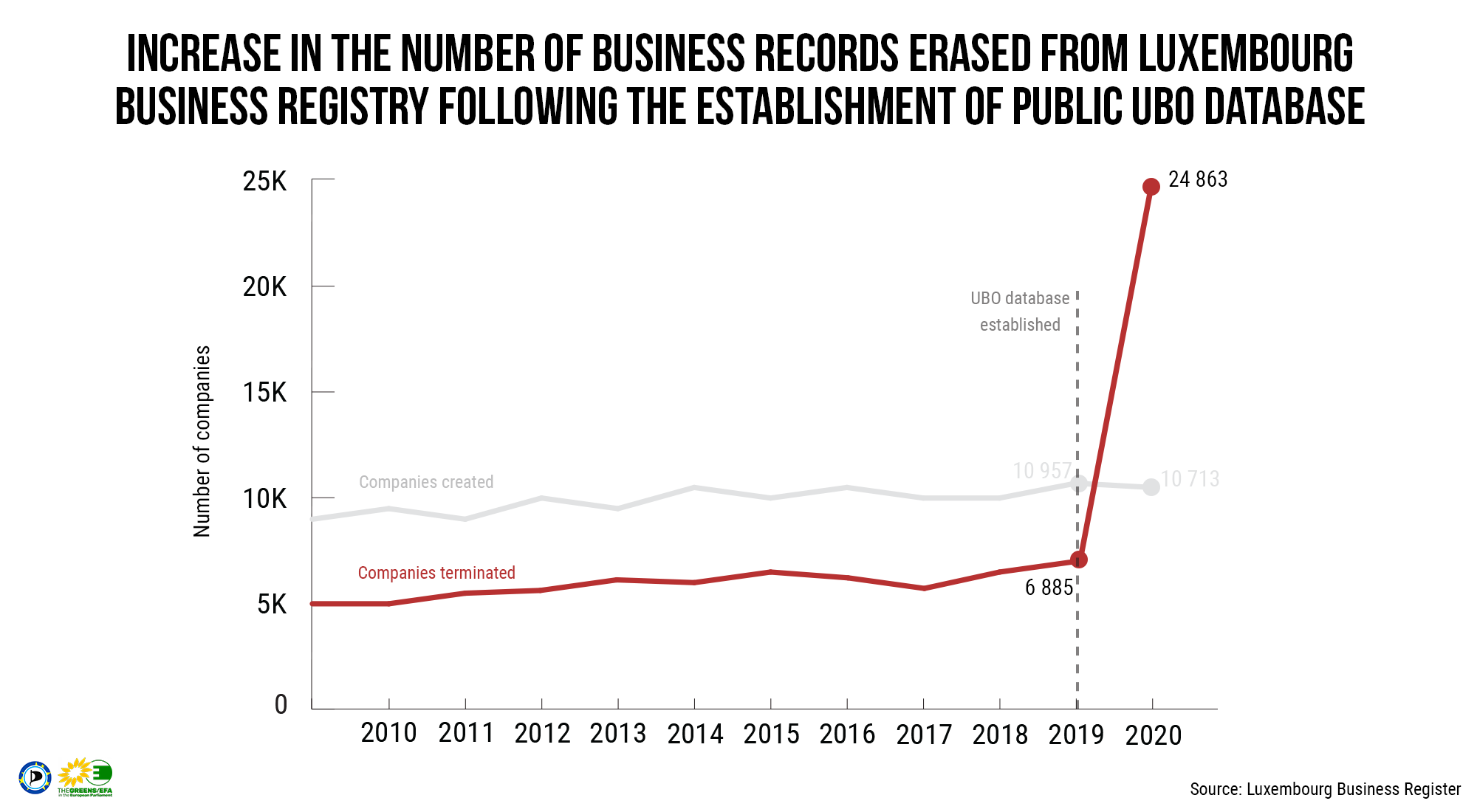

OpenLux breaks the mould of previous tax scandals in a marked way. As I explained above, the EU played an important role in disclosing unfair tax-paying practices. Markus Meizer from the Tax Justice Network pointed out, that OpenLux was singular in that it was not “just another data leak”, but rather the direct consequence of work by journalists, activists, and politicians, who have been promoting publicly accessible data for a long time now. The fact that the Luxembourg government is not willing to provide a full, user-friendly database proves that specific and enforceable European legislation is just as important as transparent and fair accounting for big players. Gabriel Zucman from UC Berkley (the new director of the EU Tax Observatory) also showed that the volume of the offshore funds managed in Luxembourg is similar to Hongkong or Singapore, and amounts to less than half of those in Switzerland. That in itself ought to send a clear message to the European Union: striving for more openness is still very topical.

Pushing on

As the OpenLux example illustrates, transparency pays off, even in cases when enforceability lags behind. It is clear that public oversight makes life more difficult for shady actors, especially when we look at the number of companies that were deleted right after the register was introduced.

True, it might seem strange settling for paying ‘higher’ taxes when you can pay ‘lower’ taxes instead. This way of thinking poses a grave danger, however. If states and companies become locked in a race to the bottom, they will be unable to maintain their essential services. The outcome will be a collapse of the system of mutual cooperation between the public and the private sector. Deterioration of the environment that facilitates business and elevates the quality of life – the environment that was built on this cooperation – would shortly follow. But I will say more on that in the second part of my OpenLux special.

0 comments on “Transparency pays off I: European databases expose Luxembourgish evasion”