Mikuláš Peksa:

The new US administration is offering a change for the better in global corporate taxation. If negotiators in Brussels fail to take it up, it will be a crying shame.

The issue of globalization and its negative impact on public budgets? Old news, to say the least. Experts have been tackling the topic of “harmful tax practices” for almost twenty-five years, since the first scathing OECD report that shone a light on their global effects. (OECD. (1998). Harmful Tax Competition: An Emerging Global Issue / Organisation for Economic Co-operation and Development. Paris: OECD Publishing.) International scrutiny has, however, obviously not been enough to bring about a major change, and most states’ attitudes to global taxation have not improved since 1998. Quite to the contrary: We can recall the current arbitration regarding Ireland’s tax breaks for supranational giants such as Apple, the oft-mentioned Panama Papers, or the recently published OpenLux affair, which mapped corporate practices that allow companies to consolidate profits with minimal tax rates. This history hardly gives us the picture of a healthy environment. The arrival of a new US President heralds hope that things might start looking up, though. Janet Yellen, former Fed chief and Biden’s current Secretary of the Treasury, side-lined the demands of the Trump administration and opened the doors to a possible international compromise.

To fully understand what makes this change of mind in the US so crucial, we need to explain the fundamental elements of the planned shake-up to corporate purses. The current situation clearly favours huge supranational corporations – especially those that employ vast numbers of people and can easily cause a shock to regional employment statistics if they shift their economic activities elsewhere. Politicians willing to accept responsibility for factory closures and budgetary gaps are few and far between in democratic countries. This allows big businesses to have taxes tailor-made for them or to cherry-pick the best tax rates. The OECD proposal disturbs this imbalance of power by introducing two key pillars: changes to states’ tax law frameworks and a guaranteed global minimum tax.

The first pillar might seem like a mere formality, but do not underestimate its importance. The global economy has grown more complicated, while “digital” business has become more prevalent, with companies that may not necessarily be physically present in a given country but are still capable of generating massive profits for it. It is therefore paramount that countries agree on the first pillar. A clear definition of economic activity and an agreement on what gives the state a right to demand taxes will let us set clear rules that will prevent taxation wars and resolve disputes between states and companies alike. Without that, the new system would basically be impossible to enforce.

The main obstacle in negotiations, however, was not the first pillar, but the second. That gives the new taxation requirements clear and fixed outlines by establishing a minimum effective taxation rate. That represents one of the few ways to truly overcome one of the biggest issues in global tax evasion: base erosion and profit shifting (BEPS). This crown jewel of corporate accounting represents a toolbox of practices that exploit loopholes in tax legislations – by inflating and then deducting costs or by directly shifting profits “to greener pastures”.

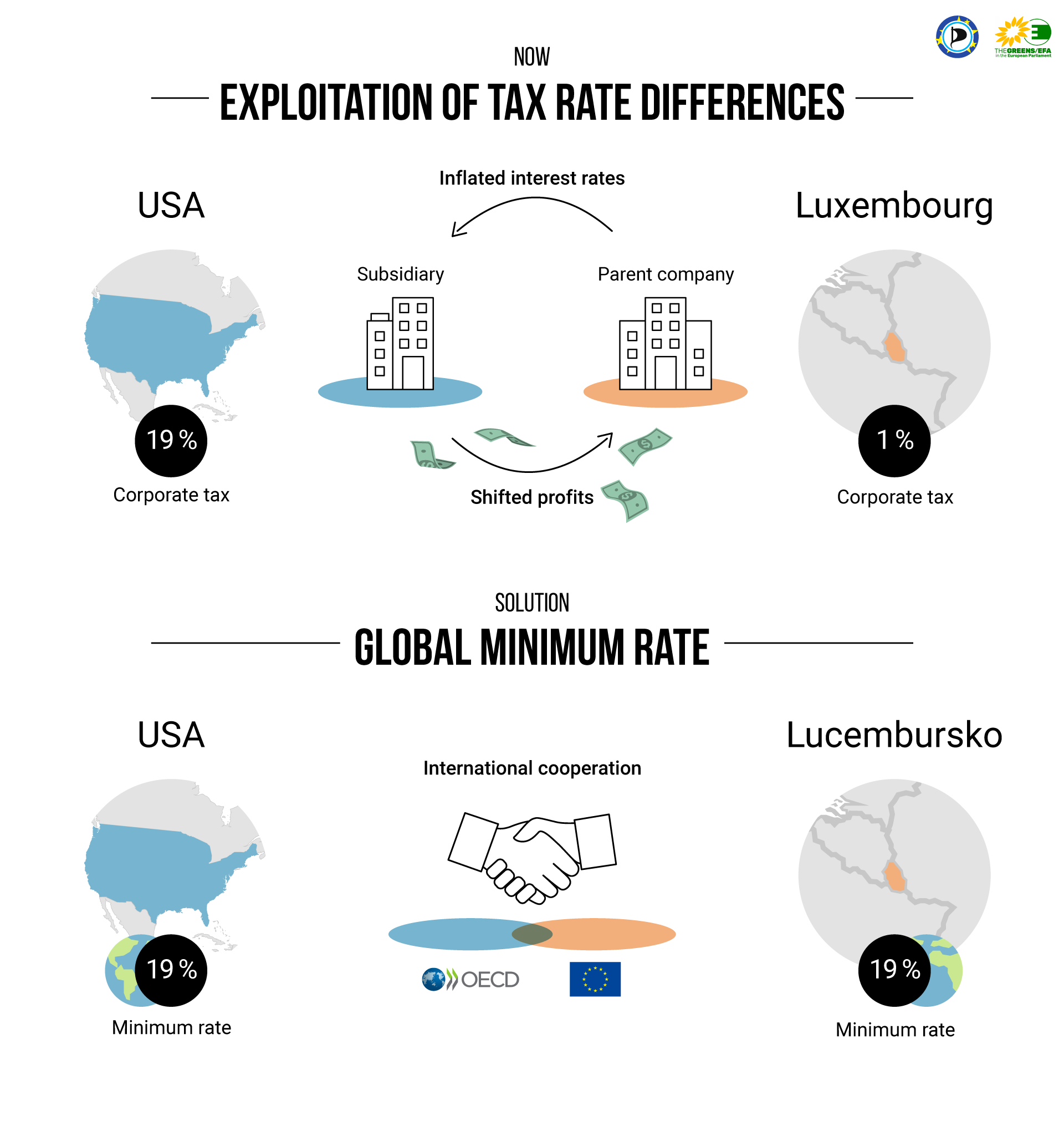

To illustrate these practices, we can use the following example: Imagine an American company whose parent company is based in a tax haven, such as Luxembourg, where the corporate tax rate is around one percent. The federal corporate tax rate is around 21 % of the company’s profits (the difference between revenues and costs), which makes it quite close to the “global” rate of 19 % that some European politicians have considered. How do you turn 21 % to 1 %, though? The American company may deduct costs, meaning higher costs equal lower profits and lower taxes. The parent company can help with that – for example by giving out loans with inadequately high interest rates or by overpricing the goods or services they supply to their subsidiary. The parent company can then get a “cheaper” tax rate at home. In the Czech Republic, we might recognize these practices from an affair concerning the mines in Ostrava and Karvinná. In this case, the parent company Karbon Invest shifted huge amounts of money out of the subsidiary OKD. (https://a2larm.cz/2021/04/privatizace-okd-byla-tragedie-ktera-negativne-ovlivnila-vsechny-aspekty-zivota-v-moravskoslezskem-kraji/) If you want to take a closer look at corporate taxation loopholes, the Deputy Editor of MoneyWeek Tim Bennett provides a nice overview in this video.

Profit shifting and cost inflation allow giants such as Google and Facebook to only pay a fraction of the local tax rate. Through international collaboration, the second pillar prevents these practices by recognizing the right of all parties to a minimum tax rate. If a company manages to push its tax rate below this threshold in a given country, the relevant tax authority will have the right to demand they make up this shortfall. Not only will this prevent profit shifting outside of the economies that host companies’ true economic activities; it will also lower the motivation of states to aggressively set unrealistically low tax rates. This ‘top up tax’ will let countries of origin ensure that the total tax rate for a given company’s profits will always be at least the minimum.

This minimum threshold was a major thorn in the side of the Trump administration. US digital giants were amongst the companies that would be the hardest hit by the second pillar. Under Stephen Munchin, the US Department of the Treasury made their approval of the OECD’s plan conditional on establishing a “safe haven” for US big tech, meaning the new rules would be entirely opt-in for these corporations. From the narrow point of view of national interests, Trump’s efforts might seem somewhat understandable. However, this exemption runs completely counter to the purpose of the proposed changes. In the Czech Republic, for example, the American-owned Google paid thirty times less in terms of taxes in 2018 than the local Seznam, which owns a similar market share. The reform would prevent exactly these situations by introducing additional taxation. Biden’s change of direction means the OECD might find consensus on how to overcome these harmful practices in the June of this year.

Yet giving all the credit to the oncoming US administration would not be exactly fair. This is most importantly the result of many years of work by the European Union alongside the OECD. Their negotiations actually started as early as 2015, after the OECD published a report mapping BEPS. After all, the reform, with its two pillars mentioned above, was the product of these very negotiations and the Trump administration was the guilty party which blocked finding a compromise by their “safe haven” proposal.

We need to remember that we’re not talking about any “additional” indirect taxes, raising the VAT, or taxation of capital as such. We’re talking about profits, which go directly into the pockets of owners and shareholders and often amount to dozens of percent of the company’s turnover. At a time when the pandemic drastically drained budget revenue and forced states to spend a great deal of money to prop up private businesses, it is entirely reasonable to ask large, multinational players to contribute their fair shares into the states’ purses in the upcoming years.

The global minimum taxation agenda is not a wild dream of a handful of radicals, as right-wing fear-mongers like to insinuate. Alarmist articles by conservative commentators crying wolf about the resurrection of “the spectre of socialism” are completely off target, at least in the field of corporate taxation. As reported by the Financial Times, plummeting tax rates have been a clear, defining trend of the last two decades.

It seems that states under the thumb of fat cats and big corporations never run out of arguments. When taxes were on the table in the early years of the new millennium, they talked about the need to protect the fragile shell of economic growth. When the question was reopened in the second decade, higher corporate taxes suddenly became a major obstacle on the way to post-crisis recovery. And in the meantime, low tax rates serve to shield us from capital flight. At the same time, the British cuts to the welfare state and public services under the pretext of “austerity”, as well as their Czech permutation, known as “fiscal consolidation” raise much fewer eyebrows.

European states are currently caught in the cycle of considering these pros and cons of minimum corporate tax, as they will have to strike a common ground before the OECD negotiations. Biden’s position proposes this tax rate to be 21 %, which is higher than the 12.5 % suggested in the original OECD proposal. I don’t know whether 21 % will become the final figure; the resulting compromise might be a slightly lower rate. The important thing is to say that this change would indeed only apply to large multinational corporations and that it would be binding.

It will be absolutely crucial that European leaders show their ability to separate the wheat from the chaff and determine which objections are relevant and which ones are the result of lobbying by corporations determined to protect their shareholders’ profits. The data from economy and international trade is clear: extremely low rates might indeed be good for shareholders, but their economic advantages are temporary at best. Not to mention that overly low tax rates only exacerbate the gaps left in public budgets by the current crisis. The inner workings of Brussels politics are famous for their ability to take fairly clear issues and produce bizarre pseudo-solutions that help no one – and this issue cannot get lost in that maze. It would be shameful if such an essential transformation of global taxation got buried because of squabbles over details or self-serving power-grabs. After all, opportunities for global change to the better are scarce in today’s world.

0 comments on “Biden’s olive branch in global taxation. Is Europe ready to accept it?”